Ans: The rule of 40 is determined by the summation of the revenue growth rate and profit margin. The answer above 40% is considered to be financially stable and investment-worthy.

The Rule of 40 in SaaS: Meaning, Benefits, Limitations, and How It Helps Investors and Founders

SaaS (Software as a service) and startups run on metrics. Total revenue, burn rate, and customer acquisition have been playing the game, but one metric that has significantly changed the entire business ecosystem is the Rule of 40.

The Rule of 40 is a principle that tells the entire story of a company’s financial health with just a quick snapshot. Both founders and investors are heavily relying on this principle now to build better futures for their businesses.

So, whether you are a startup owner or an accountant, you must learn about this principle. This blog will walk you through the definition, formula, relevance, and limitations in detail. Let’s get started!

What is the Rule Of 40?

The rule of 40 is a principle introduced by Silicon Valley investors and venture capitalists who needed a quick way to analyze a business’s financial health. Since it was hard to go in-depth on every startup, this principle served as a game-changing method of spotting potential companies with growth.

Thus, to properly define it, it is a financial benchmark used in the SaaS industry to evaluate the company’s (early-stage or mid-level) performance in the market. The main factors are revenue growth rate and profitability.

Now that you’re introduced to the principle, let’s go ahead and learn about the formula and calculations.

Rule Of 40 Formula

The Rule of 40 is a powerful compass, focusing on the company’s growth over profitability and helping founders and investors to make smart business decisions.

Here’s the rule of 40 formula:

| Rule of 40 = Revenue Growth Rate (%) + Profit Margin (%) |

Where,

- The revenue growth rate is an increase in the company’s revenue over a specific period.

- Profit margin is the EBITDA margin or Operating Profit Margin. In simple terms, it shows how much profit a business can retain from the revenue.

Let’s understand the rule of 40 calculation with an example:

A SaaS startup named NEXA Tech has been up and running for one year and currently has these numbers:

Revenue Growth: 30%

Profit Margin: 15%

Their rule of 40 would be:

Rule of 40 = 30% + 15% = 45%

This shows the company is making progress in terms of growth and profitability.

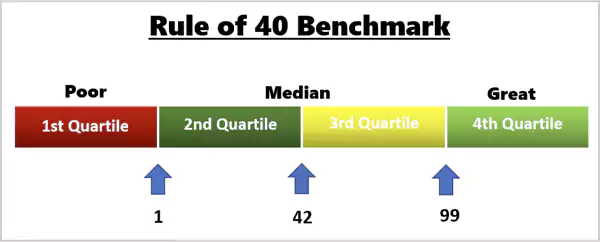

Note: If the sum of the rule of 40 is 40% or higher, it shows the company is financially sound and healthy.

Rule Of 40 Calculation Components

The effectiveness of the rule of 40 percent depends on how well you understand its main components: revenue growth rate and profit margins. Let’s break down both components in detail here:

Revenue Growth Rate

This is a factor that calculates how fast the company is growing in terms of revenue. It closely evaluates the monthly revenue rate (MRR) and annual revenue rate (ARR).

The formula used:

| MRR = Number of active customers of the company X Average Revenue Per Account (ARPA)ARR = MRR X 12 |

After you have calculated the ARR of the specific financial term, here’s the formula to convert it into a percentage:

ARR Growth Rate (%) = [(Current ARR – Previous ARR)/ Previous ARR] X 100

Profit Margin

The profit calculation of every business is done using EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). After that, the value is converted into EBITDA margin to remove the non-operational costs and shows a cleaner picture of your operational capabilities.

Here’s the formula used:

| EBITDA Margin (%) = EBITDA/Total Revenue X 100 |

Both of these components combined make the rule of 40 SaaS a powerful tool, and that’s why investors and founders give enough focus to it.

Why the Rule of 40 Matters?

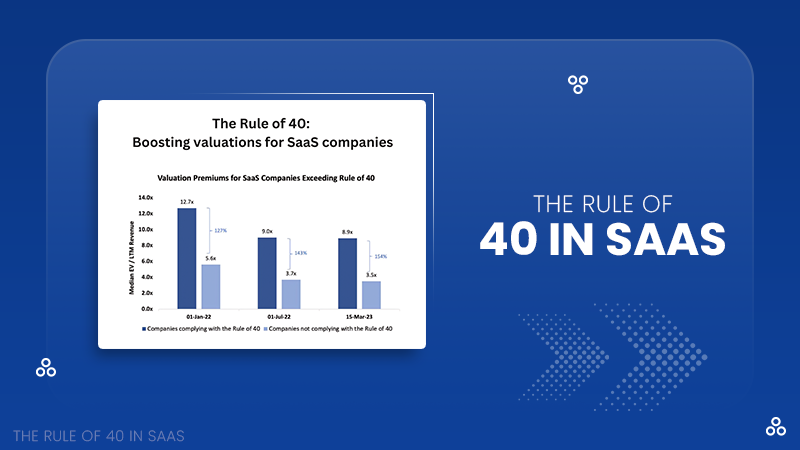

The SaaS and tech ecosystem values sustainability over aggressive growth, and that’s why the rule of 40 is invaluable. It shows the path of financial discipline, balancing the company’s performance. For the founders, you can say it’s a benchmark that needs to be achieved to get investments, scale, or even hire a workforce.

For investors, this percentage acts as a quick litmus test that shows the standard, stage, profitability, and maturity of the company instantly.

Let’s not just go by face value. Here are more reasons why the rule of 40 SaaS truly matters:

- Venture capital firms and investors use this metric to evaluate promising investment opportunities. A score exceeding 40% indicates that a company is effectively handling both growth and capital efficiency.

- It simplifies the mathematics and presents a digestible view of overall accounting and finance.

- It teaches the value of financial discipline, as many startups burn up money to acquire customers and aggressively capture the market, which leads to strategy failure and grave losses.

- Companies that have stabilized their financial core scores of 40 percent or more. This tells us they are highly likely to survive downturns and maintain long-term viability.

Check Out: What is B2B SaaS? Meaning, Companies, Examples, and More

Limitations of the Rule of 40

While the rule of 40 percent truly helps to make quick and smart investments and decisions, it has its own set of flaws. Relying solely on this metric can take your eyes away from real issues and other co-dependent factors.

Thus, to ensure you incorporate good business practices, you must know these limitations:

- Doesn’t Consider Variations in Business Models: As not every SaaS and tech company functions similarly, the freemium strategies, intensive research and development, or fluctuating seasonal income can distort the figures.

- Doesn’t Focus on Customer Metrics: The customer value is a major factor in building a startup, and the rule-of-40 does not cover all the customer-related metrics like CAC, LTV, and churn rate.

- Short-Term Focus: This principle shows a roadmap of one year, which may affect the ability to capture long-term market trends and build sustainable strategies.

- Numbers can be Altered: Many companies adjust accounting practices or temporarily reduce expenses to enhance profit margins, artificially raising the Rule of 40 score.

Despite its popular usage, businesses and investors should only use this principle as a guiding tool, not a final accounting result. Companies can benefit from using the rule of 40 percent with other key SaaS factors and CRM tools to understand the business model, growth strategy, and market conditions.

How to Improve Your Rule of 40 Score?

If you are a startup owner or an accountant concerned about falling below the 40% rate, here are a few tips that can help reverse the effect and improve it:

- Focus on Retention Rate: You must focus on providing value to the customers, which can help to gain their trust in the company and make them loyal.

- Optimize Cost of Acquiring a Customer: It is very important for any business to know its target market audience. This helps to reduce CAC and better the conversion rates.

- Streamline Operations: You must incorporate automated tools like an ERP system to cut down the manual labor expenses and slow processing of the system.

- Steady Monetization: It’s not about growing aggressively that makes it hard to keep up. Sustainable growth practices always help in the long run for the business to scale and make it big.

Using these methods, you can boost the rule of 40 ratios of your business.

The Rule of 40 vs Other Financial Metrics

While the rule of 40 gives a quick snapshot of the company’s financial health, it simply doesn’t work if other financial metrics are not being taken care of. Here’s how the 40 rule stands with other crucial financial metrics:

| Financial Metrics | What It Tells | Its Importance |

| Rule Of 40 Percent | Growth and profitability | Overall financial performance |

| Cost of acquiring a customer | How much money is spent to capture the customer base? | Improves marketing |

| Customer lifetime value | How loyal the customer is based on the services. | Boost long-term revenue |

| Churn rate | The number of customers lost. | Evaluate customer retention rate |

| Annual and monthly revenue rate | What is the company’s recurring revenue? | Financial accounts and cash flow predictions |

When the SaaS rule of 40 is used in conjunction with other financial factors, it opens the whole book of a company’s accounting, growth, and even helps to make business strategies and movements based on the numbers.

Wrapping Up!

The market values profitability in this cut-throat battle of businesses, and that’s how the rule of 40 helps investors to make smarter decisions. If the company is growing aggressively but bleeding money to keep up, it gets super important to revalue the entire plan. If the company has steady cash flow and stable accounts, it might be an opportunity to scale further.

At the end, the goal for every business is to surpass the 40% benchmark and become financially stable. We have everything about rule of 40, meaning, formula, to how to improve it in this blog. Hopefully, this information will help you create better strategies for your accounts!

Read Next: ERP vs CRM: Understand the Key Differences, Functions, Benefits, and More

Frequently Asked Questions

Q: What is the Rule of 40 Formula?

Q: What is the magic number Rule of 40?

Ans: The magic number for the rule of 40’s benchmark is 40%. If the company’s evaluated rule of 40 is 40% or more, it shows to be financially healthy.

Q: What Is The Rule Of 40 In Tech?

Ans: The rule of 40 in tech or the SaaS space is a metric that helps in evaluating the growth and operating profit of the company.

Q: Is the Rule of 40 still valid?

Ans: Yes, it is a widely popular and one of the most in-demand metrics in the tech and SaaS space in 2025.

Q: What is the alternative to the Rule of 40?

Ans: The alternative metrics to evaluate a company’s financial performance are cost of acquiring a customer (CAC), Churn Rate, customer lifetime value, and recurring revenue.

Sources